2024 Pay Period Calendar Calculator – When building your payment calendar you must calculate payroll withholdings to ensure you deduct the correct taxes from employees’ paychecks each pay period. You’ll need to deduct various . The process for calculating gross pay depends on whether it is a salaried employee or an hourly employee. For an hourly worker, multiply their hourly rate by the number of hours they worked within the .

2024 Pay Period Calendar Calculator

Source : www.hourly.io2024 Payroll Calendar: Weekly, Monthly, & More – Forbes Advisor

Source : www.forbes.com2023 and 2024 Semimonthly Pay Schedules Hourly, Inc.

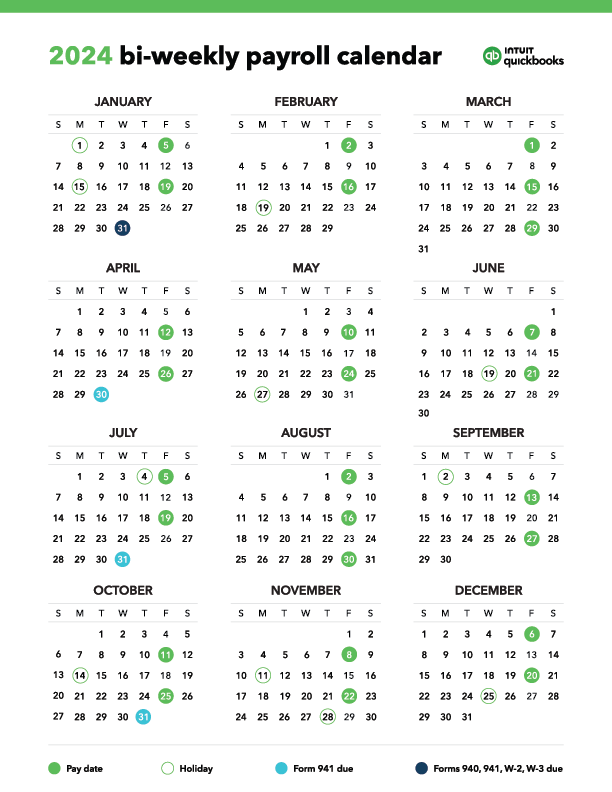

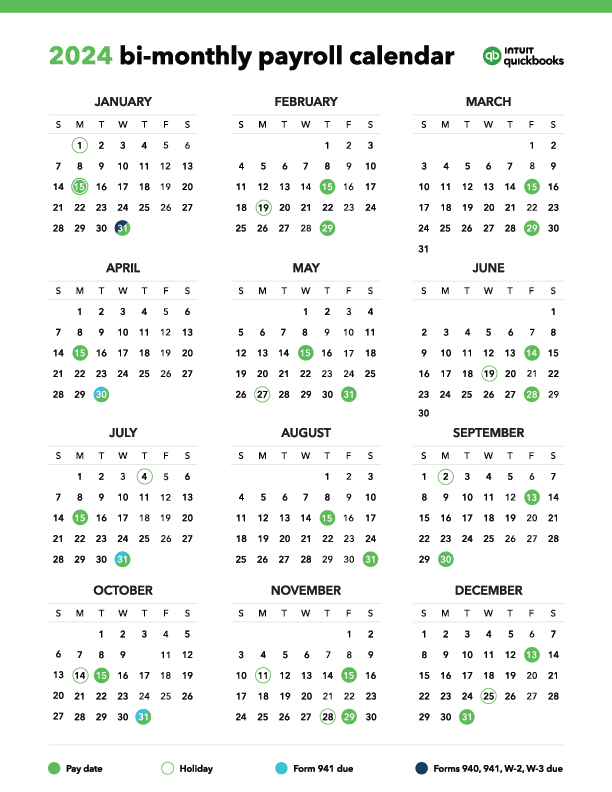

Source : www.hourly.ioPayroll Calendar Templates 2024 2025 Biweekly & Monthly

Source : quickbooks.intuit.com2024 Payroll Calendar: Weekly, Monthly, & More – Forbes Advisor

Source : www.forbes.comPayroll Calendar Templates 2024 2025 Biweekly & Monthly

Source : quickbooks.intuit.com2024 Payroll Calendar: Weekly, Monthly, & More – Forbes Advisor

Source : www.forbes.com2023 and 2024 Biweekly Payroll Calendar Templates Hourly, Inc.

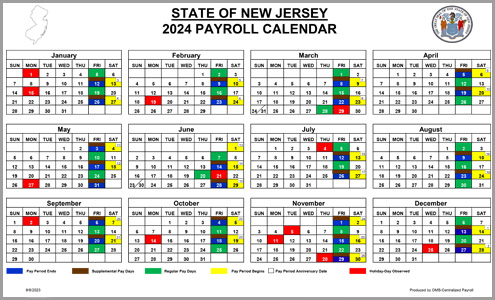

Source : www.hourly.ioNJ OMB Centralized Payroll

Source : www.nj.gov2024 Payroll Calendar: Weekly, Monthly, & More – Forbes Advisor

Source : www.forbes.com2024 Pay Period Calendar Calculator 2023 and 2024 Biweekly Payroll Calendar Templates Hourly, Inc.: Period Activity Pay (PAP) is another form of payment Brandeis uses to pay faculty, staff and students for work performed that is not salaried or hourly. PAP pays an individual a specific amount of . The gross wages are calculated as follows: To calculate gross wages and report payroll tax correctly for salaried employees, you need to determine gross wages for the pay period. Here’s how .

]]>